Wareham High School seniors get 'dose of reality' in budgeting

High school: The glory days. No worries about repaying student loans, paying rent or a mortgage, health insurance or the cost of groceries. For seniors, that will all change in just a few months.

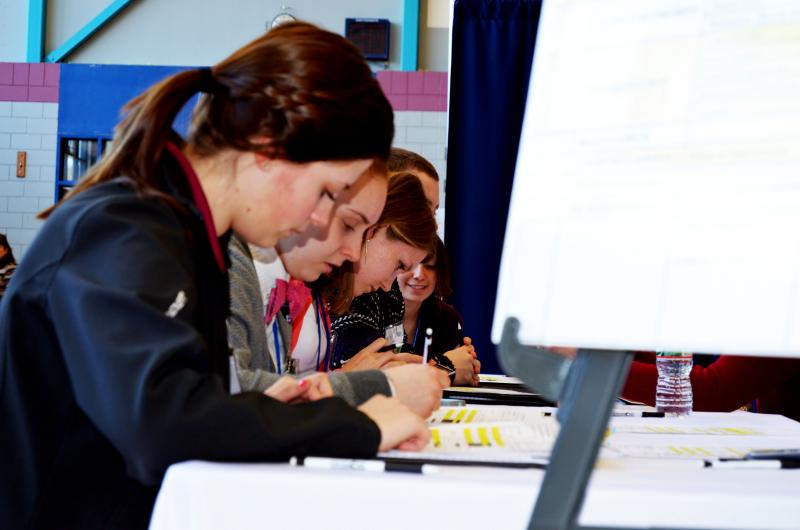

On Friday morning, a team from Cape Cod Five Cents Savings Bank brought the bank's financial litery program to the Wareham High School gym to give students a taste of real-life expenses and budgeting.

“This was an eye-opener,” said student Caitlyn Berger.

“It was a positive experience. I think a lot of people here got a reality check,” agreed Mason Vasconcellos. “I don’t know how accurate the whole thing is, but it gets the point across that life is expensive.”

Students began by selecting a career. The program then tasked students with balancing a budget -- balancing the likely income from that career with the likely expenses assiciated with it (for instance, student loans for careers requiring college), basic needs (for instance, food) and expenses associated with their desired standard of living.

“I’m a teacher,” said fellow student Shayna Santiago part-way through the morning's exercise. “Right now, I’m adding up all my past expenses for the month, and right now, I think I’m going to go over.”

Following up with Santiago a little later, she explained: “I got a part-time job. I’m stocking shelves at Home Goods overnight. I’m going to go back to food and cut back on that.”

“The day has been good,” said MacKenzie Connell, who chose business management as his career. “I’ve learned some things that have been really helpful.”

Shanice Dixon selected acting and modeling as her profession, and a food budget similar to a college freshman's: “Ramen noodles and peanut butter.”

“My major expense is healthcare because I wanted a better plan with dental,” Dixon said. “It’s extremely tough trying to get your finances together.”

“I only have $400 left over, which kind of sucks, but I guess it isn’t that bad,” Dixon added.

Dixon also picked up a second job. In real life, Dixon wants to major in communications in college.

“I feel more aware, and it reminded me why I am going to college,” she said. “It’s so tough. I could have picked engineering.”

Teachers noticed a difference in their students' approach to spending after being confronted with the workshop.

“My favorite comment was, ‘I hate this. I don’t want to spend my money. I want to keep it all, and I don’t like the idea of having to part with it,’” said teacher Cathleen Marchessault. “I think that’s a good thing because I think we all feel that way when we do our budgets at the end of the month as we age.”

“A 16-year-old Scott Palladino could have used this,” principal Scott Palladino said. “As I’m sure many of us could relate to, I had to learn through trial and error.”

“Students need to know what will happen in the real world,” said retired teacher Melvin Lazarus said. “A fair like this is exactly the way to find out. It’s a terrific idea.”

School Committee member Geoffrey Swett said students told him that the program was a dose of “harsh financial reality.”

“I think it was a great program, and I applaud the superintendent and the principal for taking the initiative to make it happen,” Swett said.

“I really like doing these events because students get a dose of reality to realize just how expensive it is to live,” said Cape Cod Five’s Chris Richards.