Town maintains single tax rate for next fiscal year

After an annual presentation on single versus split tax rates and how the two differ, the Select Board voted to maintain the single tax rate at their Nov. 18 meeting.

Under a single tax rate, residents pay a uniform percentage in taxes. Under a split rate, commercial and industrial businesses as well as personal property owners pay more in taxes.

According to Director of Assessing Jacqui Nichols, a split rate does not increase town revenue and it would have several negative impacts on the town such as increasing the taxes too much for small, local businesses to handle.

“A split rate would make Wareham less attractive to new small businesses,” Nichols said.

If the Select Board had voted to adopt the split rate, residential property owners would save $72 a year while business owners would pay an additional $799.

“The Walmarts, Home Depots and large box stores can afford that but our smaller businesses cannot,” she said.

She added the tax rate for single-family residences will likely be $8.57 for fiscal year 2026. She said this is a slight increase of two cents from last year and would bring the average yearly single family tax bill to just over $4,000.

“Out of the 351 communities in Massachusetts, Wareham is one of 44 with a tax bill under $4,500 as opposed to $7,730 which is the average for the state” she said.

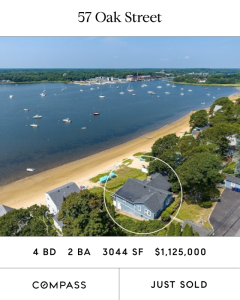

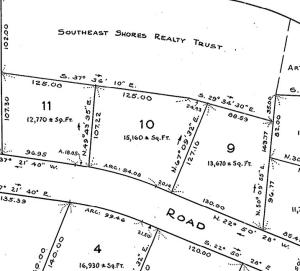

When comparing yearly single family tax bills in fiscal year 2025 to surrounding communities such as Bourne, Carver, Marion and Mattapoisett, Wareham has the lowest by $1,923 and the lowest average single family home value at $463,234.

Nichols added the average cost of a single family home will increase to $477,000 in fiscal year 2026.